Best Fintech Apps

The dynamic fintech industry continues to redefine how we manage finances. This article presents a glimpse into the future with a curated list of the top 10 best fintech apps in 2023. From revolutionary banking solutions to innovative investment platforms, explore the cutting-edge applications reshaping the financial landscape.

Key Takeaways

- Fintech apps are innovative mobile applications that leverage technology to provide diverse financial services. They encompass mobile banking, budgeting tools, investment platforms, and more, shaping the future of finance through user-friendly and accessible digital solutions.

- Types of Fintech Apps: Digital banking, Investment, Personal Finance, Blockchain and cryptocurrency, and RegTech.

- Key Features of a Good & Best Fintech App: User-Friendly Interface, Security Measures, Account Management, Payments, and Transfers, Investment Tools, Personal Finance Insights, and Regular Updates.

- 10 Best Fintech Apps in the US: Revolut, Mint, Coinbase, Venmo, Robinhood, MoneyLion, Nubank, YNAB, Chime, N26

All About Fintech Apps

Fintech apps are revolutionizing the financial sector, offering convenient solutions for banking, investing, and managing money. These applications leverage cutting-edge technology to provide users with seamless and secure experiences.

From mobile banking and budgeting to investment platforms and innovative payment solutions, fintech apps are reshaping how we interact with our finances.

5 main categories of Best fintech apps are as follows:

Digital Banking

Fintech apps have redefined traditional banking, allowing users to manage accounts, transfer funds, pay bills, and deposit checks from their mobile devices.

With intuitive interfaces and advanced security features, these apps provide a seamless banking experience, enabling customers to monitor transactions, track spending, and access financial services conveniently.

Investments

Fintech investment apps empower individuals to invest in stocks, bonds, and other assets easily. They offer personalized investment strategies, portfolio diversification, and real-time market insights, making investing accessible to a broader audience. Users can track performance, set goals, and automate investments, all through user-friendly interfaces.

Personal Finance

Fintech apps for personal finance provide comprehensive budgeting, expense tracking, and financial planning tools.

These apps analyze spending patterns, offer saving recommendations, and help users set and achieve financial goals. With visualizations of financial data and customized insights, decisions about money can be made.

Blockchain And Cryptocurrency

Fintech has driven the rise of cryptocurrencies and blockchain technology. Cryptocurrency apps facilitate buying, selling, and managing digital assets, while blockchain-based apps ensure secure and transparent transactions. These apps offer wallet services, real-time market data, and simplified crypto management.

RegTech

Regulatory Technology (RegTech) apps assist financial institutions in complying with complex regulations. These apps use automation and data analytics to streamline compliance processes, reducing operational risks and costs.

RegTech solutions help monitor transactions, identify potential breaches, and maintain regulations and standards.

Key Features of a Best Fintech App:

User-Friendly Interface:

A well-designed fintech app offers an intuitive interface that makes navigation and transactions seamless. Ensures easy navigation and accessibility for users, promoting user engagement and satisfaction. User-centric design and customization foster a sense of control over finances.

Security Measures:

Strong encryption, biometric authentication, and multi-factor verification ensure robust data security. Safeguards user data and financial transactions, fostering trust and confidence in the app. Robust security measures ensure user trust and protect against cyber threats.

Account Management:

It includes Efficient account setup, easy balance access, transaction history, and account customization options. Provides a holistic view of finances, aiding better financial management and decision-making. The Instant updates facilitate prompt decision-making and risk management.

Payments and Transfers:

Quick and hassle-free fund transfers, bill payments, and peer-to-peer transactions. Integrated bill payment features enable users to pay bills directly from the app, reducing late fees and ensuring financial stability. Automated savings and bill payments streamline financial management.

Investment Tools:

Advanced investment analysis, real-time market updates, diversified portfolio management. The Access to various investment options, such as stocks, bonds, and cryptocurrencies, empowers users to grow wealth and achieve financial goals. Diverse investment options contribute to wealth accumulation and growth.

Personal Finance Insights:

Detailed spending categorization, budgeting tools, financial goal setting, and saving recommendations. Data-driven insights based on user spending and saving patterns provide valuable economic optimization recommendations. AI-driven insights offer tailored financial recommendations.

Regular Updates:

Continuous app enhancements, bug fixes, and based on feedback, the launch of new features. Timely notifications and real-time updates inform users about transactions, account balances, and market changes. Adherence to regulations ensures a secure and compliant user experience.

10 Best Fintech Apps in the US

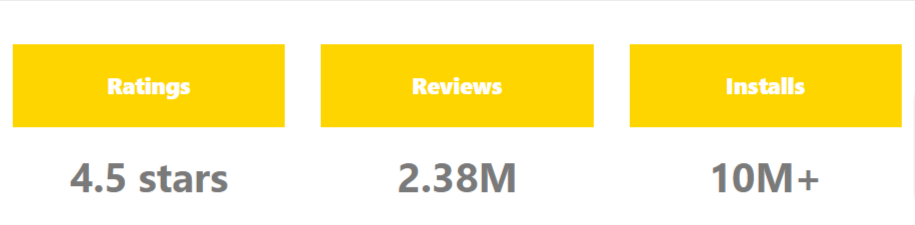

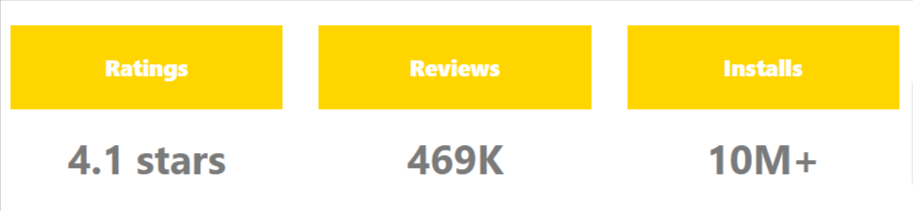

Revolut:

Revolut is one on the top 10 best fintech apps that offers financial services primarily through its mobile app. It was founded in 2015 and is known for its digital banking platform that provides various financial solutions, including currency exchange, international money transfers, cryptocurrency trading, budgeting, and spending analytics.

Features:

- Provides control over finances with multi-currency accounts and real-time transaction notifications.

- Enables spending and money transfers abroad at competitive exchange rates.

- User-friendly interfaces and innovative banking services have gained popularity.

Pros

- Multi-currency accounts

- Competitive exchange rates

- Cryptocurrency trading

- Real-time transaction notifications

- Budgeting and spending analytics

Cons

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

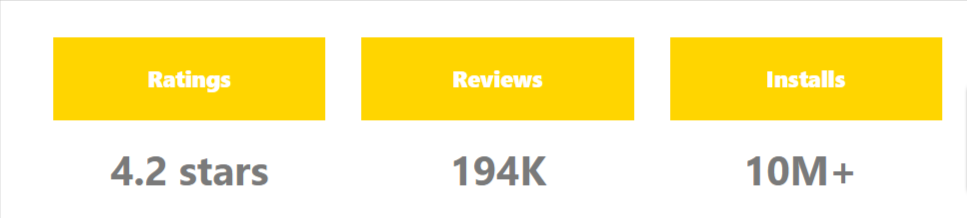

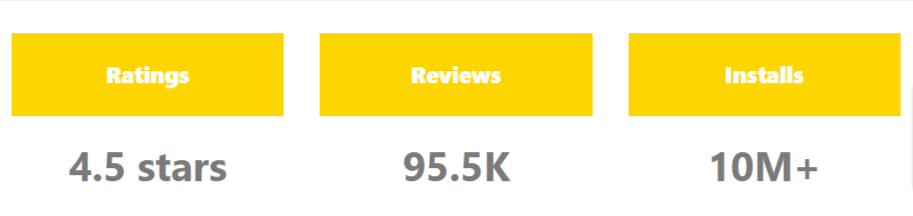

Mint:

Mint is a mobile app and personal finance management platform which allows users to track their financial transactions, create budgets, and monitor their spending and saving habits. It was founded by Aaron Patzer in 2006 and launched in 2007.

Mint quickly gained popularity for its user-friendly interface and automated features that help individuals manage their money more effectively. In 2009, Mint was acquired by Intuit Inc., the company behind popular financial software like QuickBooks and TurboTax.

Features:

- Mint offers expense tracking, budgeting, bill payment reminders, credit score monitoring, and financial goal setting.

- Automatically categorizes transactions and provides insights into spending patterns.

- It’s a web-based mobile app aiming to enhance money management for individuals.

Pros

- User-friendly interface

- Budgeting and expense tracking

- Financial insights

- Alerts for bills and unusual transactions

- Free to use

Cons

- Security concerns for linking accounts

- Limited customer support

- Ads and product recommendations

- It may not support all financial institutions

- Requires constant internet connections

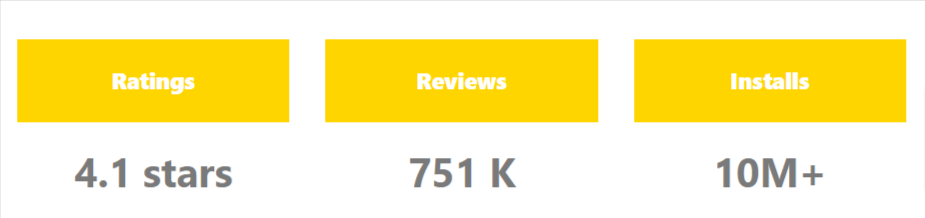

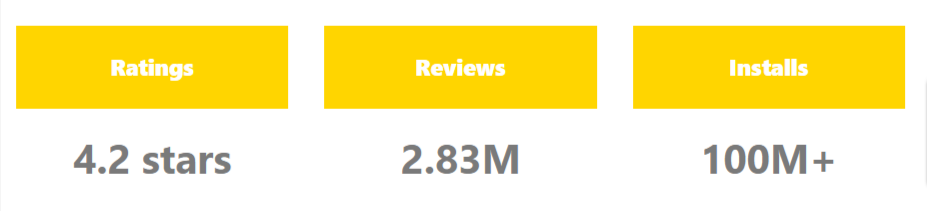

Coinbase

Coinbase is a digital currency exchange platform that allows users to sell, buy, and store cryptocurrencies, including Bitcoin, Ethereum, etc. It provides a user-friendly interface for trading and managing cryptocurrencies and features like secure wallet storage and educational resources. It’s popular among both beginner and experienced cryptocurrency enthusiasts.

Features:

- Secure wallets

- Advanced trading on Coinbase Pro

- Recurring buys

- Educational resources

- Mobile app

- Crypto-to-crypto conversions

- Merchant services

- Secure authentication

- Regulatory compliance

- Instant withdrawals

- Staking options

Pros

- User-friendly interface

- Wide range of supported cryptocurrencies

- Strong security measures

- Mobile app for easy access

- Educational resources

Cons

- Limited control over private keys

- Transaction fees

- Customer support can be slow

- Limited availability in some countries

- Potential account restrictions

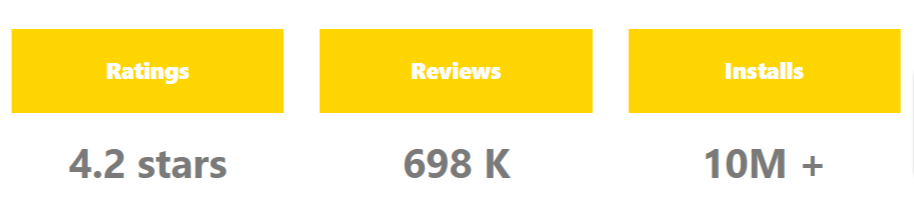

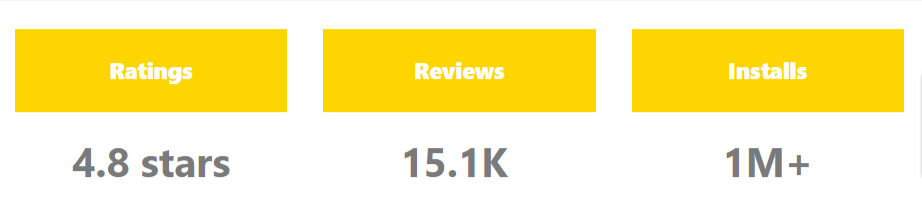

Venmo:

Venmo is a mobile payment service that allows users to receive and send money to/from friends and family members. It’s often used to split bills, pay for shared expenses, and make informal transactions. Venmo is known for its social feed feature, where users can see and interact with each other’s transactions.

Features:

- Quick and easy money transfers

- Social feed for transaction viewing and engagement

- Payment splitting for shared expenses

- Optional Venmo debit card for spending

- Available as a mobile app for convenient peer-to-peer transactions

Pros

- Convenient peer-to-peer money transfers

- Social feed for transaction visibility

- Splitting bills and expenses

- Venmo debit card for spending

- User-friendly mobile app

Cons

- Limited international usability

- Privacy concerns with social feed

- Fees for certain transactions

- It may require linking to a bank account

- Customer service issues reported

Robinhood:

Robinhood is a trading platform and application that enables users to engage in commission-free activities such as selling, purchasing, and trading stocks, options, cryptocurrencies, and exchange-traded funds (ETFs), all without the requirement of conventional brokerage fees or commissions.

It aims to democratize investing by making trading more accessible to a wide range of people.

Features:

- User-friendly interface

- Real-time market data

- Customizable watchlists

- Essential research tools

- Fractional shares and recurring investments

- Cash management account for enhanced accessibility to investing

Pros

- Commission-free trading

- User-friendly interface

- Access to stocks, options, and cryptocurrencies

- Fractional shares and recurring investments

- Cash management account

Cons

- Limited research tools

- Customer support issues

- Outages during high market volatility

- Limited investment options compared to traditional brokers

- Controversies related to business practices.

MoneyLion:

MoneyLion is a fintech enterprise that provides a variety of financial services and products via its mobile application. It aims to empower users to take control of their financial lives by providing budgeting, investing, credit-building, and borrowing tools.

The company aims to provide a comprehensive platform that helps users achieve their financial goals and improve their overall economic well-being.

Features:

- Personalized financial advice

- Budgeting tools

- Credit monitoring

- Investment options

- Loan access

Pros

- All-in-one financial platform

- Personalized financial advice

- Investment options

- Credit monitoring and building tools

- Rewards Program

Cons

- Limited customer service options

- Fees for certain services

- Some users may find the app overwhelming

- Not available to international users

- Limited physical branch presence

Nubank:

Nubank, also known as Nu Pagamentos S.A., is a Brazilian neobank that offers various financial services through its mobile app. Established in 2013, it has become renowned for its easily navigable digital banking solutions and the absence of fees for its services.

Features:

- Credit card services

- Digital payment accounts

- Personal loans

- Investment options

- Primarily serves the Brazilian market

- Focuses on hassle-free and transparent financial services

Pros

- Fee-free credit card and accounts

- User-friendly mobile app

- Transparent and straightforward services

- Quick and easy account setup

- Innovative financial products

Cons

- Limited international availability

- Limited physical branch access

- Limited range of financial services compared to traditional banks

YNAB:

YNAB, which stands for “You Need A Budget,” is a software designed for budgeting and managing personal finances. It aids users in proficiently overseeing their funds by assigning distinct purposes to every dollar.

It encourages proactive budgeting, saving for future expenses, and tracking spending habits. YNAB aims to promote financial awareness and control by emphasizing intentional money allocation.

Features:

- Budgeting categories for precise allocation

- Real-time syncing across devices

- Goal setting for savings and debt reduction

- Transaction tracking and categorization

- Reporting tools for financial insights

- Debt paydown planning

- Educational resources for financial literacy

Pros

- Effective budgeting tool

- Encourages saving and responsible spending

- User-friendly interface

- Goal setting and tracking

- Regular updates and support

Cons

- Subscription cost

- Initial learning curve

- Limited investment tracking

- Manual transaction entry

- It may not suit complex financial needs

Chime

Chime is a neobank, an online-only bank that operates without physical branches. Its mobile application and website provide a range of financial offerings, encompassing checking and savings accounts, debit card services, direct deposit capabilities, and specific attributes frequently linked with conventional banking institutions.

Chime is known for its user-friendly interface, early direct deposit feature, and lack of many conventional banking fees. It has gained popularity for providing accessible and modern banking services to users who prefer managing their finances digitally.

Features:

- Fee-free banking, no overdraft or monthly fees

- Early direct deposit access

- Automatic savings transfers from direct deposits

- Round-up savings for spare change

- Mobile app for remote account management

- Visa debit card with cashback rewards

- Real-time transaction alerts

- Budgeting tools and spending insights

Pros

- Fee-free banking

- Early direct deposit

- Automatic savings features

- User-friendly mobile app

- Cashback rewards on debit card

- Real-time transaction alerts

Cons

- Limited physical presence

- Some account limits

- Customer service quality varies

- May lack certain advanced banking features

- Possible occasional technical glitches

N26

N26 is a digital bank headquartered in Berlin, Germany. It is known as a neobank or online-only bank, which operates exclusively through its mobile app and website, without physical branch locations.

N26 offers a range of banking services and features designed to provide a modern and convenient banking experience for its users. These offerings encompass checking and savings accounts, debit card services, fund transfers, tools for budgeting, and more.

N26 has gained popularity for its user-friendly interface, transparent fee structure, and ability to cater to individuals who prefer managing their finances digitally.

Features:

- Mobile-only bank

- Checking and savings accounts

- Contactless Mastercard debit card

- Fee-free foreign currency transactions

- Instant money transfers

- Budgeting and spending insights

- Savings Spaces for goal setting

- Biometric login and security features

Pros

- Mobile-centric banking

- Transparent fee structure

- Fee-free foreign transactions

- Instant transfers

- User-friendly app

- Biometric security

Cons

- Limited physical presence

- Basic savings options

- Variable customer support

- Fewer advanced features

- Possible account limitations

- Not suitable for complex business needs

Benefits Of Having A Fintech App On Mobile Phone

- Convenience: Access financial services and manage accounts anytime, anywhere.

- Ease of Use: Intuitive interfaces make transactions and tracking effortless.

- Speedy Transactions: Execute transactions and payments quickly and securely.

- Real-time Monitoring: Keep track of financial activities in real time for better control.

- Budgeting Assistance: Utilize built-in tools for budgeting and expense tracking.

- Savings and Investments: Seamlessly manage savings and investments within the app.

- Secure Transactions: Fintech apps offer robust security features for safe transactions.

- Paperless Environment: Reduce paper usage through digital transactions and statements.

- Financial Insights: Gain insights into spending habits and financial patterns.

- Personalized Experience: Receive tailored recommendations based on your financial behavior.

- Mobile Payments: Make contactless payments using your mobile device.

- Accessibility: Fintech apps cater to various financial needs and goals.

- Innovative Features: Explore new financial products and services within the app.

- Cost Savings: Many fintech apps offer lower fees and competitive rates.

- Global Access: Access international financial services without geographical restrictions.

- Reduced Wait Times: Skip the lines at traditional banks with app-based services.

- Financial Education: Some apps offer resources to improve financial literacy.

- Simplified Transactions: Complex transactions made user-friendly through the app.

- Flexibility: Manage multiple financial aspects within a single platform.

- Track Investments: Monitor investment portfolios and market trends conveniently.

- Future Planning: Set financial goals and monitor progress within the app.

Incorporating a fintech app into your mobile phone can revolutionize how you manage your finances, offering convenience, security, and a range of financial services at your fingertips.

Trends In The Growth Of The Fintech Industry

- Mobile-First Approach: Fintech apps are increasingly designed for mobile devices, catering to the rising use of smartphones for financial services.

- Digital Payments: Rapid adoption of digital payment solutions, including mobile wallets, contactless payments, and peer-to-peer transfers.

- Blockchain and Cryptocurrencies: Integrating blockchain technology and cryptocurrencies in various financial services, from remittances to investments.

- Neobanks: Emergence of neobanks, digital-only banks with user-friendly interfaces, disrupting traditional banking models.

- Open Banking: Implementation of open banking APIs, allowing third-party developers to create innovative financial solutions and services.

- AI and Automation: Enhanced customer experiences through AI-driven chatbots, personalized recommendations, and automated financial management.

- RegTech: Utilization of regulatory technology to streamline compliance processes and ensure adherence to financial regulations.

- InsurTech: Technology integration in insurance services, offering personalized coverage, quick claims processing, and digital policy management.

- Robo-Advisors: Growth of robo-advisory platforms for automated investment management, providing accessible and low-cost investment options.

- Financial Inclusion: Fintech solutions address the unbanked and underbanked populations, enabling access to financial services globally.

- Sustainable Finance: Incorporation of environmental, social, and governance (ESG) factors into fintech offerings, promoting sustainable investing.

- Embedded Finance: Incorporating financial services into platforms not primarily focused on finance, like online shopping websites and social media networks.

- Cybersecurity Focus: Heightened focus on cybersecurity to safeguard sensitive financial data in an increasingly digital landscape.

- API Economy: Collaboration and partnerships through APIs allow fintech companies to offer comprehensive services without reinventing the wheel.

- Cross-Border Payments: Streamlined and cost-effective cross-border payment solutions, reducing friction in international transactions.

- Lending Innovation: Evolution of lending models through peer-to-peer lending, alternative credit assessment, and microloans.

- Regulatory Changes: Adapting to evolving regulations and compliance requirements across jurisdictions.

- Health and Wealth Integration: Fusion of health and wealth data to offer holistic financial wellness solutions.

The fintech industry is dynamic and continues to evolve rapidly, driven by technological advancements and changing consumer preferences. These trends collectively shape the landscape of financial services, creating new opportunities and challenges for both consumers and businesses.

Cost Estimation For Fintech App Development

Supplying a precise cost estimate for developing a fintech app can be intricate, as it hinges on diverse aspects like functionalities, intricacy, platform, team location, and other considerations.

However, the following is a general breakdown of potential cost components:

- Development Team: The team’s size, location, and experience level significantly impact costs. This includes developers, designers, testers, and project managers.

- Features and Functionality: The complexity and number of features, such as account management, payments, budgeting tools, and security measures, influence development time and costs.

- Platform: Developing for iOS, Android, or both affects costs due to platform-specific requirements and coding.

- Design: User interface (UI) and user experience (UX) design are essential for fintech apps, affecting development time and costs.

- Security: Fintech apps require robust security measures, including encryption, authentication, and regulation compliance. Implementing these features can impact costs.

- Integration: If your app needs to integrate with third-party services like payment gateways or banking APIs, integration complexity can influence costs.

- Testing and Quality Assurance: Rigorous testing for functionality, security, and usability is crucial. Testing efforts can contribute to overall development costs.

- Regulatory Compliance: Fintech apps often must adhere to financial regulations, which can involve additional development work and costs.

- Maintenance and Updates: Ongoing maintenance, updates, and support contribute to long-term costs.

- Infrastructure and Hosting: If you’re building a backend system for the app, costs related to hosting, databases, and server maintenance are considerations.

- Prototyping and MVP: If you start with a minimum viable product (MVP) to test your app’s viability, costs might be lower initially.

Keep in mind that costs can vary widely. A basic fintech app could start around $50,000 to $100,000, while more complex apps with advanced features could exceed $200,000. It’s advisable to consult with experienced app development agencies or professionals to get a tailored cost estimate based on your specific requirements.

Frequently Asked Questions

The "best" finance app can vary based on individual preferences and financial needs. However, some top contenders in the fintech industry include apps like Mint, YNAB (You Need A Budget), Personal Capital, Chime, N26, and Acorns.

Choosing the best finance app depends on budgeting, investment goals, banking services, and user experience.

Money-tracking apps prioritize security and employ encryption, authentication, and other measures to protect users' financial data. Reputable apps comply with industry standards and regulations to ensure data privacy.

However, it's advisable to research an app's security features, read reviews, and only use apps from trusted sources.

There is an expectation that the Fintech industry will undergo a compound annual growth rate surpassing 22% per year, leading to its expansion from $11.8 billion in 2018 to around $306 billion by the year 2023.

Fintech apps leverage AI and machine learning to offer personalized insights, predictive analysis, and automation.

These technologies analyze users' financial behaviors to provide tailored budgeting suggestions, investment recommendations, fraud detection, and credit scoring. They enhance efficiency and accuracy in economic decision-making.

Yes, numerous fintech applications provide investment functionalities, enabling users to engage in investing in stocks, exchange-traded funds (ETFs), as well as cryptocurrencies.

Apps like Robinhood, SoFi, and E*TRADE offer stock trading, while platforms like Coinbase and Binance enable cryptocurrency trading.

Emerging trends in the fintech industry include decentralized finance (DeFi), central bank digital currencies (CBDCs), green fintech focusing on sustainable investing, and increased integration of financial services into non-financial platforms (embedded finance).

These trends will likely influence fintech apps by expanding functionalities, offering innovative investment options, and improving financial inclusivity.