Fintech, an abbreviation for “financial technology,” represents a swiftly changing domain situated at the confluence of finance and technology.

In recent years, fintech apps have taken the financial world by storm, revolutionizing how we manage, invest, and interact with money. These innovative applications harness cutting-edge technologies to provide a wide range of financial services, making them an integral part of today’s digital landscape.

Fintech has reshaped traditional banking, payments, investment, and lending practices. Fueled by creative ideas and technological advancements, fintech startups are driving financial innovation, making financial services more accessible, convenient, and efficient for individuals and businesses alike.

As consumers increasingly embrace digital financial solutions, the significance of fintech in the modern economy cannot be overstated.

Fintech Startup Ideas

In this article, we’ll explore many creative fintech startup ideas that tap into this thriving industry, offering inspiration and insights for aspiring entrepreneurs and tech enthusiasts.

From beginner-friendly projects to innovative business concepts, the fintech startup landscape is teeming with opportunities to make a meaningful impact while fueling innovation in the financial world.

Let’s dive into the exciting realm of fintech and uncover the possibilities that lie ahead.

Key Takeaways:

- Fintech apps are revolutionizing traditional financial services in the USA by offering convenient digital solutions that enhance accessibility, efficiency, and security for consumers and businesses.

- In 2023, trending fintech app ideas for startups include decentralized finance (DeFi) platforms, AI-powered financial advisors, and blockchain-based supply chain finance solutions. These innovative ideas harness cutting-edge technologies to address evolving financial needs.

- Successful FinTech apps exhibit user-friendly interfaces, robust security measures, and seamless integration with financial systems, ensuring a positive user experience and trust.

9 Revolutionizing Traditional Financial Services in the USA

Fintech apps are at the forefront of a financial revolution in the USA, reshaping traditional financial services. These innovative applications leverage technology to offer convenient, efficient, and customer-centric solutions, challenging the status quo of the finance industry.

Here’s how fintech apps are making their mark:

1- Banking Reinvented:

Fintech apps offer digital banking services with no physical branches, giving users easy access to their accounts, payments, and budgeting tools through their smartphones. They eliminate the need for traditional banks and their associated fees.

2- Payments Simplified:

Payment apps have transformed how we transact. They facilitate peer-to-peer payments, split bills, and enable quick, contactless payments. Mobile wallets like Apple Pay and Google Pay are now widely accepted by retailers.

3- Investment Accessibility

Fintech startups have democratized investing. Apps offer fractional shares, robo-advisors, and easy-to-understand interfaces, allowing novice investors to participate in the stock market with minimal barriers.

4- Lending Made Easier:

Online lending platforms connect borrowers with a network of lenders, streamlining loan approvals and providing alternatives to traditional banks. This fosters financial inclusion.

5- Personal Finance Management:

Fintech apps provide users with sophisticated tools to manage their finances, including budgeting, expense tracking, and financial goal setting. They empower individuals to take control of their money.

6- Insurance Innovations:

Insurance technology (insurtech) startups offer customized insurance policies, faster claims processing, and data-driven pricing models, transforming the insurance landscape.

7-Blockchain And Cryptocurrencies:

To provide safe and decentralized financial transactions, fintech has introduced cryptocurrencies and blockchain technology. Digital currencies like Bitcoin and Ethereum have received a great deal of praise.

8-RegTech and Compliance:

Regulatory technology (RegTech) solutions help financial institutions automate compliance processes, reducing errors and costs while ensuring adherence to complex regulations.

9-Small Business Support:

Fintech startups offer small businesses access to financing, accounting, and payment solutions, leveling the playing field for entrepreneurs.

In summary, fintech apps are breaking down barriers and enhancing financial services’ accessibility, affordability, and efficiency in the USA. They challenge traditional financial institutions to adapt to a new era of innovation and customer-centricity, promising a future where financial services are more inclusive and tailored to individual needs.

15 Fintech App Ideas for Startups Trending in 2023

In 2023, the fintech landscape in the USA continues to evolve, offering numerous opportunities for innovative startups. Here are some trending fintech app ideas:

1- Digital Wallet for Cryptocurrencies:

Develop a secure and user-friendly digital wallet app that allows users to store, manage, and transact with cryptocurrencies like Bitcoin and Ethereum.

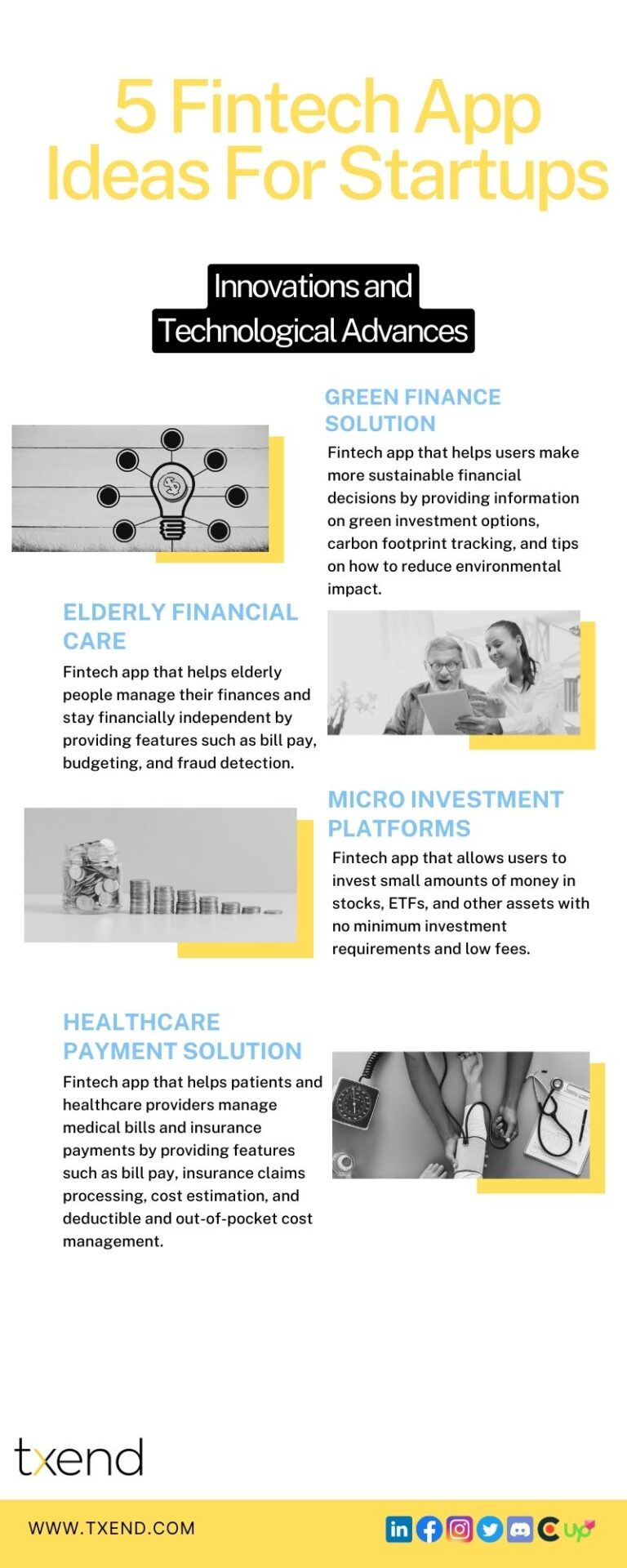

2- Micro-Investment Platforms:

Create an app that enables users to invest small amounts of money in diversified portfolios or specific assets, making investment accessible to a broader audience.

3- Expense Tracking and Financial Planning:

Build an app that helps users track expenses, set budgets, and plan for financial goals. Incorporate AI for personalized financial advice.

4- Peer-to-Peer Lending:

Facilitate peer-to-peer lending by connecting borrowers with individual lenders. Implement robust credit scoring algorithms for risk assessment.

5- AI-Powered Chatbots for Customer Service:

Develop AI-driven chatbots for financial institutions to enhance customer support, answer queries, and provide financial guidance.

6- Green Finance Solutions:

Create a fintech app that promotes environmentally responsible investing and provides tools to assess the environmental impact of financial decisions.

7- Regulatory Compliance Tools:

Build RegTech solutions that assist financial institutions in navigating complex regulations, automating compliance processes, and reducing compliance costs.

8-Healthcare Payment Solutions:

Develop a secure platform for healthcare providers and patients to manage medical bills, insurance claims, and payments seamlessly.

9- Personalized Insurance Platforms:

Create an insurance app that offers personalized insurance policies based on user data and behavior, providing cost-effective coverage.

10- Decentralized Finance (DeFi) Solutions:

Using blockchain technology, explore the DeFi space by building decentralized lending, borrowing, and yield farming platforms.

11-Small Business Financial Management:

Offer fintech services tailored to small businesses, including accounting, invoicing, payroll, and access to working capital.

12-Real Estate Investment Platforms:

Enable users to invest in properties through fractional ownership or crowdfunded real estate investment platforms.

13- Elderly Financial Care:

Develop apps that cater to the unique financial needs of the elderly, including retirement planning, estate management, and healthcare cost analysis.

14- Personal Data Monetization:

Create a platform that allows users to control and monetize their data, sharing it with businesses in exchange for rewards.

15- Financial Literacy and Education:

Build educational fintech apps to enhance financial literacy among users, covering topics like investing, budgeting, and retirement planning.

These fintech app ideas align with the evolving financial technology landscape in the USA. Startups that leverage these trends can provide valuable solutions to consumers and businesses, driving innovation and growth in the fintech sector.

15 Qualities of Successful Fintech App Startups

In the competitive landscape of fintech apps, several key qualities contribute to the success of these applications in the USA:

1- Security and Trust:

Ensuring robust security measures and compliance with regulatory standards is paramount. Successful fintech apps prioritize protecting user data and transactions to build trust.

2- User-Friendly Interface:

A seamless and intuitive user interface is essential. Fintech apps should be easy to navigate, with clear and concise design elements for users of all backgrounds.

3- Personalization:

Personalization is a significant driver of user engagement. Successful apps leverage data to offer tailored experiences, from personalized financial recommendations to targeted offers.

4- Seamless Integration:

Fintech apps should integrate smoothly with existing financial services, making it convenient for users to link their accounts, cards, and other financial tools.

5- Innovation and Adaptability:

Staying ahead of industry trends and adopting emerging technologies like AI, blockchain, and open banking is vital. Successful apps continuously innovate to meet evolving user needs.

6- Transparency:

Transparent pricing, fees, and terms are essential. Users should clearly understand how the app operates and how it benefits them financially.

7-Strong Customer Support:

Offering responsive and helpful customer support is crucial. Whether through chatbots or human agents, addressing user concerns promptly fosters loyalty.

8- Speed and Reliability:

Users expect fast and reliable service. Fintech apps must deliver quick response times, minimal downtime, and efficient transaction processing.

9- Financial Education:

Providing educational resources and tools within the app helps users make informed financial decisions, increasing their financial literacy.

10- Regulatory Compliance:

Staying compliant with financial regulations is non-negotiable. Successful fintech apps invest in compliance measures to avoid legal issues.

11- Data Analytics:

Leveraging data analytics to offer insights into spending habits, investment opportunities, and financial health can be a distinguishing feature.

12- Partnerships and Ecosystems:

Building partnerships with financial institutions and other fintech companies can expand the app’s ecosystem, offering users more comprehensive financial solutions.

13- Scalability:

Successful fintech apps are designed for scalability, accommodating user growth without compromising performance or security.

14-Sustainability:

Incorporating sustainable and ethical practices like green finance options resonates with users who prioritize responsible financial choices.

15- Feedback Integration:

Actively seeking user feedback and incorporating it into app updates demonstrates a commitment to improving the user experience.

Fintech startups prioritizing these qualities have a higher chance of building successful apps that resonate with users, foster trust, and drive innovation in the USA’s dynamic financial technology landscape.

Successful Fintech Startup Ideas

Certainly! Here are three successful fintech startup ideas that have impacted the USA:

Robo-Advisors:

Robo-advisers are automated investment platforms utilizing algorithms to offer financial planning and investment management services. These platforms have gained popularity for their accessibility and cost-effectiveness.

They offer users personalized investment strategies based on their financial goals and risk tolerance. Successful Robo-advisors like Betterment and Wealth front have attracted a significant user base by making investing more straightforward and affordable.

Peer-to-Peer Lending:

Peer-to-peer (P2P) lending platforms like LendingClub and Prosper have disrupted the traditional lending industry. These platforms connect borrowers directly with individual investors willing to fund their loans.

P2P lending offers borrowers more accessible loan options, often with competitive interest rates, while investors can earn returns by lending their money.

The success of these platforms lies in their ability to simplify the lending process and offer better terms to borrowers and lenders.

Digital Payment Solutions:

Fintech startups in the digital payment sector have introduced innovative solutions for everyday transactions. Square, for instance, offers small businesses a simple way to accept card payments using their smartphones or tablets.

Now owned by PayPal, Venmo provides a user-friendly platform for peer-to-peer payments. These startups have reshaped how people and businesses handle payments, making transactions more convenient and efficient.

These examples showcase the diversity of fintech startup ideas, from investment and lending platforms to digital payment solutions. Successful fintech startups in the USA often identify pain points in traditional financial services and leverage technology to offer more accessible, cost-effective, and user-friendly alternatives.

Launching A Fintech Startup In The USA

When launching a fintech startup in the USA, it’s crucial to focus on several key aspects for success:

Regulatory Compliance:

Understand and comply with the complex regulatory landscape of the financial industry. Ensure that your business model adheres to federal and state regulations, including licenses and permits where required.

Market Research:

Thoroughly research the market to identify gaps and opportunities. Understand your target audience’s needs and preferences. Analyze competitors and their offerings to find a unique value proposition.

Security and Data Privacy:

Security is paramount in fintech. Implement strong security measures to safeguard user data and transactions and adhere to data privacy regulations such as GDPR and CCPA.

Technology Infrastructure:

Invest in a robust and scalable technology infrastructure. Choose the right technology stack for your fintech solution. Ensure high availability and disaster recovery capabilities.

User Experience (UX):

Design an intuitive and user-friendly interface. For businesses to keep customers, a good user experience is essential. Conduct usability testing to refine your app or platform.

Partnerships:

Collaborate with financial institutions, banks, and payment processors. Building strategic partnerships can help with funding, resource access, and credibility.

Monetization Strategy:

Develop a clear monetization strategy. Determine how you’ll generate revenue through subscription fees, transaction fees, or other means.

Scalability:

Plan for scalability from the beginning. Ensure your fintech solution can handle increased user volumes as your business grows.

Customer Support:

Provide excellent customer support. Promptly address user queries and concerns. Customers who are satisfied are more inclined to recommend your business to others.

Marketing and Promotion:

Create a solid marketing plan to promote your fintech startup. Utilize digital marketing, social media, and content marketing to reach your target audience.

Analytics and Insights:

Implement analytics tools to track user behavior and gather insights. Use this data to make informed decisions and continuously improve your offering.

Compliance with Trends:

Keep up with the latest developments in fintech, including blockchain, artificial intelligence, and machine learning. Consider how these innovations can enhance your services.

Launching a fintech startup in the USA demands a comprehensive strategy that addresses legal, technical, customer-centric, and competitive aspects. You may improve your chances of success in this fiercely competitive sector by concentrating on five important areas.

Future of the Fintech Startup Market

The future of the Fintech startup market in the USA appears promising and dynamic. Several trends and developments are shaping its trajectory:

Continued Growth:

The fintech sector is expected to grow, driven by increased adoption of digital financial services, changing consumer preferences, and technological advancements.

Regulatory Environment:

Fintech startups must adapt to evolving regulatory requirements. Compliance will remain a crucial aspect of operating in the financial industry.

Innovation:

Startups will focus on innovative solutions that enhance financial inclusion, provide personalized services, and leverage emerging technologies like blockchain, AI, and decentralized finance (DeFi).

Financial Inclusion:

There will be a strong emphasis on addressing financial inclusion by offering services to underserved populations and providing access to banking, lending, and investment opportunities.

Open Banking:

The open banking trend will continue to gain momentum, enabling startups to access financial data securely and create value-added services.

Decentralized Finance (DeFi):

DeFi projects will disrupt traditional finance by offering decentralized lending, borrowing, and trading services, providing more control and transparency to users.

Cybersecurity:

With increased digitization, cybersecurity will remain a top priority. Fintech startups will invest heavily in robust security measures to protect user data and transactions.

Partnerships:

Collaborations between fintech startups, established financial institutions and tech giants will expand. These partnerships can provide access to resources, funding, and a broader customer base.

Digital Currencies:

As digital currencies gain acceptance, fintech startups may explore opportunities in the cryptocurrency space, including wallet services, exchanges, and blockchain-based financial products.

AI And Automation:

These technologies will drastically streamline business operations, improve consumer experiences, and cut expenses.

Sustainability:

As investors and consumers become more interested in sustainability, fintech businesses will increasingly incorporate environmental, social, and governance (ESG) concepts into their business models.

Data Analytics:

Data analytics will drive personalized financial services, enabling startups to offer tailored solutions based on user behavior and preferences.

In summary, the future of the fintech startup market in the USA is characterized by innovation, technology integration, and a commitment to addressing evolving consumer needs. As the industry continues to evolve, creative fintech startup ideas that cater to these trends will likely succeed in this dynamic landscape.

Frequently Asked Questions

Ideal programming languages for fintech apps include Python, Java, and JavaScript for versatility and security.

Launch costs vary but can be high due to compliance, technology, and talent; fundraising is common.

Fintech startup success varies; many factors like innovation, market fit, and execution influence outcomes.

Fintech companies aren’t banks but offer financial services; regulations distinguish them from traditional banks.

Fintech apps generate revenue through fees, subscriptions, partnerships, and data monetization.

Validate fintech app ideas by market research, user feedback, prototypes, and MVP testing for viability and demand.

Conclusion | 15 Creative Fintech Startup Ideas Trending In 2023

In conclusion, creative fintech startup ideas are the driving force behind innovation in the financial industry. Embracing these ideas can fuel innovation, transforming how we handle finances and opening new opportunities for businesses and consumers.

Entrepreneurs with innovative ideas and a dedication to quality will play a crucial role in determining the direction of finance as the fintech market continues to change.

Exploring these financial app ideas can help you succeed in this dynamic and attractive industry, whether you’re a novice or a seasoned professional. So, take the plunge, harness your creativity, and embark on a journey to fuel innovation through fintech startup ideas.

if you work as freelancer if any buyer message you on fiverr, upwork, freelancer or anywhere Quick Alert for Freelancers and Entrepreneurs Software will instantly notified you by Phone call.