Fintech In Healthcare

In modern advancements, the convergence of health and wealth has given rise to a transformative synergy: Fintech in Healthcare.

This harmonious alliance signifies financial technology integration within the healthcare landscape, ushering in a new era of innovation and efficiency.

From leveraging AI in fintech to blockchain applications, the role of financial technology in healthcare is revolutionizing how medical services are accessed, managed, and paid for.

This article delves into the intricate interplay between financial technology and healthcare, exploring how this dynamic partnership is reshaping patient experiences, streamlining operations, and paving the way for a healthier and wealthier future.

Key Takeaways

- Fintech in healthcare enhances patient payments and financial experiences while providing innovative financing and bolstering data security.

- Fintech innovations in the US healthcare sector include AI-driven diagnostics, blockchain for secure data, and telehealth solutions, improving access and efficiency.

Impacts Of Fintech In Healthcare

Streamlining Patient Payments: Revolutionizing Healthcare Financial Transactions

Financial technology in healthcare is streamlining patient payments, simplifying billing processes, and offering convenient payment options.

Patients can manage their healthcare expenses more efficiently, reducing the financial burden.

Redefining Healthcare Accessibility

The synergy of fintech and healthcare enhances patient financial experience.

Digital solutions give patients easy access to financial information, enabling them to make informed decisions about their healthcare costs.

Transforming Healthcare Affordability

Fintech is introducing innovative financing solutions in healthcare.

Patients can explore flexible payment plans and access loans specifically tailored to their medical needs, making quality healthcare more affordable.

Transparency In Healthcare Pricing

One of the key impacts of financial technology in healthcare is the increased transparency in pricing.

Patients can now compare prices for medical services and choose the most cost-effective options, promoting competition and driving down costs.

Fortifying Data Security: Safeguarding Patient Information

Fintech is strengthening data security in healthcare.

Advanced encryption, blockchain technology, and stringent cybersecurity measures are safeguarding patient data, ensuring its confidentiality and integrity.

These impacts collectively signify the transformative role of financial technology in healthcare in the USA, leading to improved financial accessibility, transparency, and security for patients while streamlining healthcare financial processes.

How Does Fintech Innovate The Healthcare Sector In The USA?

Streamlining Healthcare Payments:

Innovative Billing Platforms:

Fintech companies like Cedar offer patient-centric billing platforms that make it easier for patients to understand their medical bills and provide multiple payment options.

Payment Plans:

Platforms like CareCredit offer healthcare financing solutions, allowing patients to pay for medical expenses over time, often with low or no interest.

Enhanced Patient Financial Experience:

Digital Wallet Integration:

Fintech solutions integrate digital wallets, allowing patients to make contactless payments for healthcare services and prescriptions.

Personal Financial Dashboards:

Companies like MedPut provide patients with personal financial dashboards to manage medical expenses and access personalized advice.

Innovative Financing Solutions:

Healthcare Loans:

Fintech firms like Affirm Health offer healthcare loans with transparent terms, enabling patients to afford elective procedures or manage unexpected medical costs.

Crowdfunding Platforms:

Platforms like GoFundMe and YouCaring help individuals raise funds for medical treatments, showcasing the social impact of fintech in healthcare.

Price Transparency Tools:

Comparison Engines:

Fintech apps like Healthcare Bluebook allow patients to compare prices for medical procedures and find cost-effective options.

Insurance Shopping:

Companies like Stride Health help individuals find suitable health insurance plans based on their needs and budgets.

Data Security Solutions:

Blockchain for Medical Records:

Fintech startups like MedRec leverage blockchain technology to enhance the security and integrity of electronic health records, ensuring that sensitive patient data remains private.

Cybersecurity Solutions:

Fintech companies like Medigate focus on securing medical devices and networks in healthcare facilities, protecting against cyber threats.

These innovations illustrate how fintech is reshaping the healthcare landscape in the USA.

By streamlining payments, enhancing patient experiences, offering innovative financing, promoting price transparency, and fortifying data security, fintech drives positive changes and improves access to quality healthcare services.

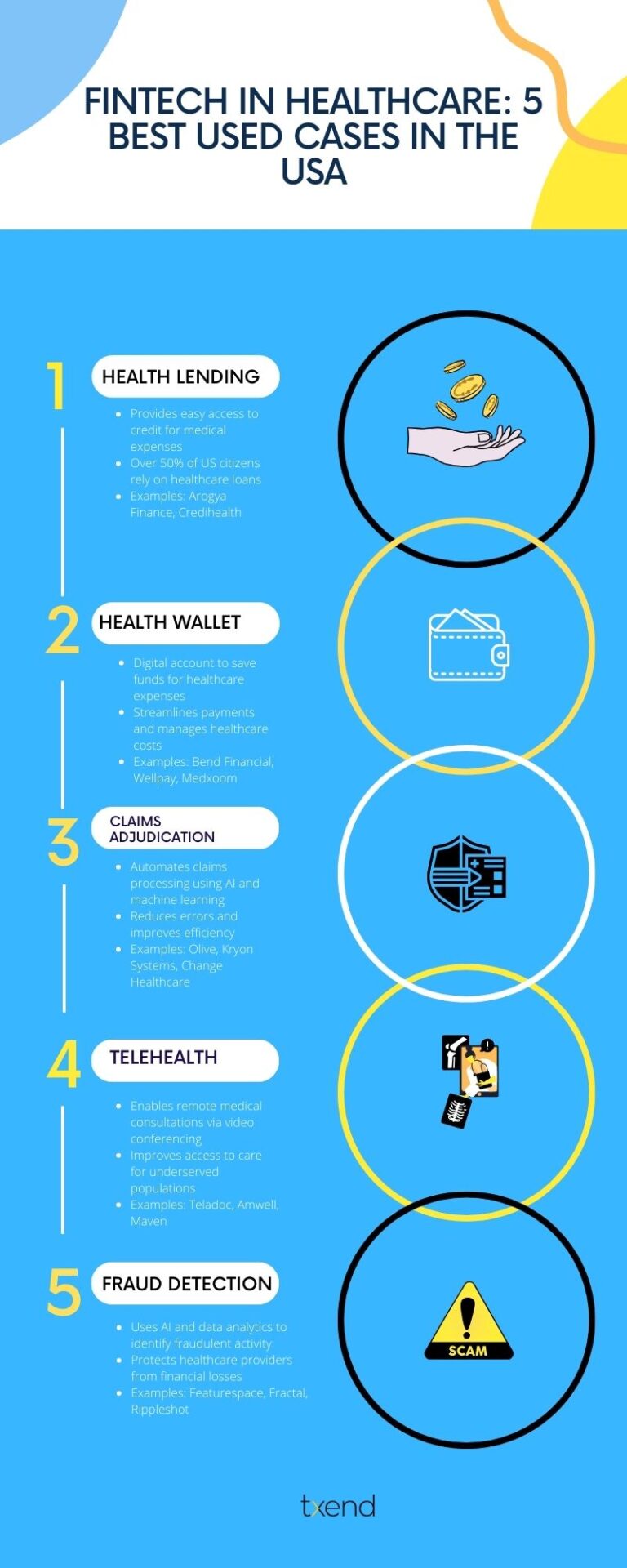

5 Used Cases Of Fintech In Healthcare In The USA

Certainly, let’s explore some real-time cases of financial technology in healthcare in the USA:

Teladoc Health:

Overview:

Teladoc Health is a telemedicine company that uses fintech solutions to enable virtual doctor visits and consultations.

Fintech Integration:

Patients can use Teladoc’s platform to connect with healthcare providers, and fintech elements come into play when it’s time to pay for these services.

Example:

Teladoc offers a seamless payment process where patients can securely pay for virtual medical visits using digital wallets or credit cards.

This simplifies the financial aspect of healthcare, making it convenient for patients.

Oscar Health:

Overview:

Oscar Health is an insurance company that combines technology and healthcare services.

Fintech Integration:

Oscar’s fintech approach involves data analytics and personalized health insurance offerings.

Example:

They use AI-driven tools to help customers find the right health insurance plans based on their healthcare needs and financial situations.

This innovative approach simplifies the traditionally complex process of choosing health insurance.

GoodRx:

Overview:

GoodRx is a healthcare fintech company that provides a platform for finding prescription drug prices and discounts.

Fintech Integration:

GoodRx offers price transparency in healthcare by aggregating data on drug prices and providing users with discounts and coupons.

Example:

Patients can use the GoodRx app to compare drug prices at different pharmacies and access coupons to lower their out-of-pocket expenses for prescription medications.

Cedar:

Overview:

Cedar is a fintech company specializing in patient financial engagement.

Fintech Integration:

Cedar’s platform simplifies and personalizes the patient billing experience.

Example:

Many healthcare providers in the USA use Cedar’s technology to send electronic bills to patients, provide clear explanations of charges, and offer various payment options, including flexible payment plans.

This fosters better financial experiences for patients.

Medici:

Overview:

Medici is a telehealth platform that incorporates fintech elements for billing and payment.

Fintech Integration:

Medici offers secure payment processing for telehealth services.

Example:

Patients can have virtual consultations with healthcare providers via the Medici app, and after the session.

They can conveniently pay for the services within the app using digital payment methods.

These real-time cases demonstrate how fintech is being actively applied in the healthcare sector in the USA, improving patient experiences, streamlining financial transactions, and increasing transparency in healthcare costs.

Future Trends Of Fintech In Healthcare In The USA

Certainly, here are some future trends of financial technology in healthcare in the USA:

Blockchain for Medical Records:

Overview:

Blockchain technology offers secure, decentralized storage of medical records. Patients can control their data, granting access to healthcare providers when needed.

Implication:

This trend enhances data security and interoperability, reducing the risk of data breaches and improving patient data sharing among providers.

AI-Driven Personalized Medicine:

Overview:

Artificial intelligence (AI) and machine learning are increasingly used to analyze patient data and provide personalized treatment plans.

Implication:

AI-driven insights can lead to more effective treatment options, faster diagnosis, and better patient outcomes.

Telehealth Expansion:

Overview:

Telehealth, driven by fintech solutions, will continue to grow, making healthcare more accessible and convenient.

Implication:

Patients can consult with healthcare providers remotely, reducing the need for physical visits, especially for routine check-ups or minor health issues.

Digital Payment Solutions for Healthcare:

Overview:

Fintech innovations will lead to more streamlined and secure payment processes for healthcare services.

Implication:

Patients can expect hassle-free payment experiences, transparent billing, and various payment options, including digital wallets and payment plans.

Healthcare Tokenization:

Overview:

Tokenization of healthcare assets and services will become more prevalent, allowing for fractional ownership and investment in healthcare-related assets.

Implication:

This trend can democratize healthcare investment and enable new financing models for healthcare projects.

Healthcare Analytics for Cost Reduction:

Overview:

Advanced analytics will be used to identify cost-saving opportunities within healthcare systems.

Implication:

Healthcare providers can optimize resource allocation, reduce inefficiencies, and lower the overall cost of care.

Rise of Health Financiers:

Overview:

Fintech companies that focus exclusively on healthcare financing will emerge.

Implication:

These specialized firms will offer tailored financial solutions, such as medical loans and health savings accounts, to help patients manage healthcare expenses.

Cybersecurity Advancements:

Overview:

As fintech applications in healthcare expand, so will the need for robust cybersecurity measures.

Implication:

Investments in healthcare cybersecurity will increase to protect sensitive patient data from cyber threats.

Patient-Provider Collaboration Platforms:

Overview:

Fintech solutions will facilitate better communication and collaboration between patients and healthcare providers.

Implication:

Patients can actively participate in their care decisions and access educational resources through digital platforms.

Regulatory Frameworks For Fintech In Healthcare:

Overview:

Governments will establish clearer regulations to ensure the safe and ethical use of financial technology in healthcare.

Implication:

These regulations will provide a stable environment for fintech companies to innovate while safeguarding patient rights and data.

These trends reflect the evolving landscape of fintech in healthcare in the USA, where technology continues to play a pivotal role in improving healthcare access, quality, and efficiency.

Frequently Asked Question:

Fintech streamlines healthcare payments, enhances data analysis, and expands telehealth, transforming accessibility and efficiency.

Examples include telehealth platforms, AI-driven diagnostics, and digital payment solutions.

Blockchain ensures secure, transparent, and interoperable healthcare data, benefiting patient records and medical supply chains.

Conclusion

In conclusion, fintech’s integration into healthcare is revolutionizing the industry.

lThe synergy between health and wealth, as evidenced by AI-driven diagnostics, blockchain-enabled security, and innovative financial solutions, holds immense potential for improving patient care and financial management in the USA.

As we navigate this evolving landscape, the future of fintech in healthcare promises even greater advancements, ensuring a healthier and more prosperous future for all.