Digital Wallet App Development

Welcome to the digital age, where convenience meets innovation through digital wallet app development. Understanding the intricacies of creating efficient, secure, and user-centric digital wallet applications becomes essential as transactions shift from physical to virtual realms.

In this comprehensive guide, we delve into the future of digital wallets and provide insights into crafting exceptional digital wallet experiences in the dynamic landscape of the USA.

Join us on this journey to explore the evolution, trends, security, and development strategies that shape the realm of digital wallet apps.

Industry Overview Of Wallet App

Digital wallet app development has taken center stage in the ever-evolving financial technology landscape. A digital wallet, often called an e-wallet or mobile wallet, is a secure digital tool that allows users to store, manage, and facilitate various financial transactions, from payments and money transfers to loyalty programs and identification.

In recent years, the digital wallet industry has experienced remarkable growth, driven by its convenience, efficiency, and enhanced security measures. Renowned digital wallet companies like Apple Pay, Google Pay, and PayPal have revolutionized how people handle their finances.

These giants, among others, have played a pivotal role in shaping the digital wallet market, catering to diverse consumer needs.

The digital wallet market share has recently showcased a notable shift towards mobile-based payment systems. With increasing smartphone adoption and seamless integration with online and offline platforms, digital wallets are projected to continue their upward trajectory.

As we delve deeper into our guide, we’ll uncover the strategies and insights needed to successfully tap into this dynamic market.

Why Should One Invest In Digital Wallet App Development?

nvesting in digital wallet app holds significant promise as the financial landscape evolves. Here’s why you should consider this endeavor:

Benefits of Digital Wallets:

Digital wallets offer a myriad of advantages for both users and businesses. They provide streamlined and secure payment processes, reducing the need for carrying physical cards.

With features like loyalty programs and seamless integrations, digital wallets enhance user convenience and loyalty. For businesses, digital wallets facilitate quicker transactions, reduced operational costs, and valuable data insights for personalized services.

Growth and Future Scope:

The growth trajectory of digital wallets is impressive. The future looks promising with the proliferation of smartphones and the inclination towards contactless transactions.

As mobile payment solutions become more mainstream, digital wallets are positioned to become an essential part of daily life. Their potential to disrupt traditional payment systems and expand into various sectors further amplifies their future scope.

Incorporating digital wallet app development into your business strategy aligns with changing consumer preferences and positions you at the forefront of a technology-driven financial ecosystem, ensuring sustainable growth and enhanced customer experiences.

Why Every Fintech Startup Develops an E-wallet App in the USA?

The rise of digital wallets presents compelling reasons why every fintech startup should consider developing an e-wallet app in the USA:

Changing Consumer Preferences:

Consumers increasingly prefer convenient, contactless, secure payment methods. E-wallets align with these preferences, offering seamless transactions and reducing reliance on physical cards.

Market Potential:

The USA boasts a vast and tech-savvy population, making it a prime market for e-wallet adoption. Fintech startups recognize the immense potential for capturing a significant user base.

Competitive Edge:

E-wallets differentiate fintech startups by offering innovative financial solutions. Launching an e-wallet app can position startups as disruptors, setting them apart from traditional financial institutions.

User-Centric Features:

E-wallet apps provide functionalities beyond payments, such as loyalty programs, rewards, and budgeting tools. Fintech startups can offer enhanced user experiences that resonate with modern consumer needs.

Revenue Streams:

E-wallets enable startups to generate revenue through transaction fees, partnerships, and value-added services. This diversification contributes to financial sustainability.

Adaptation To Trends:

E-wallets align with the evolving financial landscape. Fintech startups that embrace this trend demonstrate adaptability to changing consumer behaviors.

By developing an e-wallet app, fintech startups position themselves for growth, innovation, and relevance in the ever-evolving financial technology space in the USA.

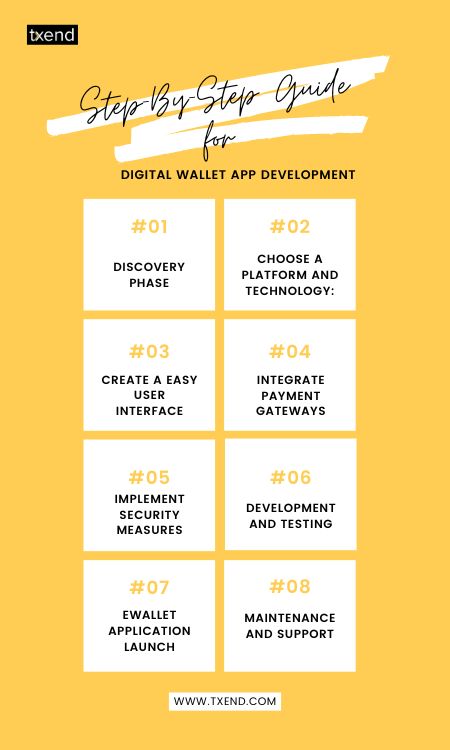

Step-By-Step Guide For Digital Wallet App Development

Certainly, here’s a step-by-step guide tailored to the USA market:

Discovery Phase:

Define the app’s purpose, target audience, and unique features. Perform market analysis to pinpoint user requirements and assess rival offerings.

Choose A Platform And Technology:

Select the platforms (iOS, Android, or both) and the appropriate technologies (programming languages, frameworks) based on your target audience and development team’s expertise.

Create A Easy User Interface:

Design a user-friendly and intuitive interface. Prioritize easy navigation, seamless interactions, and a visually appealing design that aligns with your brand.

Integrate Payment Gateways:

Integrate popular and secure payment gateways to facilitate transactions within the app. Ensure compatibility with various payment methods and currency options.

Implement Security Measures:

Enforce strong security protocols to safeguard user data, transactions, and confidential details. Use encryption, two-factor authentication, and adhere to compliance standards.

Development and Testing:

Develop the app’s front-end and back-end functionalities. Conduct comprehensive testing, utilizing both automated and manual techniques, to identify and rectify bugs, glitches, and potential security weaknesses within the app.

eWallet Application Launch:

Prepare for the app’s launch by submitting it to relevant app stores (Apple App Store, Google Play Store). Ensure your app description, visuals, and metadata are optimized.

Maintenance and Support:

After launch, provide ongoing maintenance and support. Monitor app performance, promptly address user feedback, and release updates to enhance features and security.

Navigating through these steps with a strategic approach and attention to detail can lead to the successful development of a digital wallet app that resonates with users in the dynamic fintech landscape of the USA.

Technology Stack For Digital Wallet App Development

The technology stack involves tools, languages, and frameworks to ensure seamless functionality and user experience. Below is a concise outline of the fundamental elements:

Front-End Development:

Programming Languages:

JavaScript, TypeScript for dynamic and interactive UI.

Frameworks:

React Native for cross-platform development, ensuring consistent user experiences on iOS and Android.

UI/UX Design:

Tools like Adobe XD, Sketch, or Figma for creating intuitive and visually appealing interfaces.

Back-End Development

Programming Languages:

Python, Java, Node.js for server-side logic.

Frameworks:

Django, Spring Boot, Express.js for building efficient and scalable back-end systems.

Database Management:

SQL databases (MySQL, PostgreSQL) or NoSQL databases (MongoDB) for storing user data securely.

Payment Gateway Integration

APIs:

Integrate popular payment gateways like PayPal, Stripe, or Square for secure transactions and seamless in-app payments.

Encryption:

Implement strong encryption protocols to ensure sensitive payment data remains secure.

Security Measures

Authentication:

Implement OAuth, JWT, or similar user authentication and authorization mechanisms.

Data Encryption:

Utilize SSL/TLS for encrypting data in transit and techniques like AES for data at rest.

Tokenization:

Replace sensitive data with tokens to enhance security during transactions.

Cloud Services

Hosting:

Services like Amazon Web Services (AWS) or Microsoft Azure for scalable and reliable hosting.

Storage:

Cloud-based storage solutions (Amazon S3, Google Cloud Storage) for secure data storage and retrieval.

APIs and Third-Party Services:

API Integration:

Integrate APIs for services like geolocation, push notifications, and social media sharing to enhance app functionality.

By selecting the appropriate technologies and tools for each layer of the technology stack, you can ensure a robust, secure, and efficient digital wallet app development process that aligns with the evolving demands of the USA’s digital wallet landscape.

How To Set Up A Secure Digital Wallet in the USA?

Setting up a secure digital wallet in the USA involves these key steps:

Choose a Reputable Provider:

Select a trusted digital wallet provider with a proven security and user privacy track record. Research their security features, encryption standards, and compliance with relevant regulations.

Download And Install The App:

Visit the app store (Google Play Store, Apple App Store) and download the official digital wallet app from your chosen provider. Verify the app’s authenticity before installation.

Create an Account:

Register with the app using your personal information. Create a robust and distinct password, and enhance security by activating two-factor authentication (2FA) as an additional protective layer.

Link to Trusted Funding Sources:

Connect your digital wallet to trusted funding sources like bank accounts or credit/debit cards. Ensure the payment methods you link are secured with strong passwords and proper authentication.

Enable Biometric Authentication:

Many digital wallet apps offer biometric authentication options like fingerprint or facial recognition. Enabling these features enhances security by adding an additional layer of protection.

Use Strong Encryption:

Ensure your digital wallet uses end-to-end encryption for all transactions and communications. This prevents unauthorized access to your sensitive data.

Keep Software Updated:

Regularly update your digital wallet app to the latest version. Frequent updates typically encompass security enhancements that tackle weaknesses and bolster the system’s overall security.

Beware of Phishing:

Be cautious of phishing attempts. Limit the entry of your credentials solely to the authorized app, and refrain from clicking on dubious links or sharing personal information through email.

Set Transaction Limits and Alerts:

Configure transaction limits and enable real-time alerts for every transaction. This adds an extra layer of control and helps you detect any unauthorized activity quickly.

Regularly Monitor Activity:

Frequently review your transaction history and account activity. If you notice any discrepancies or unfamiliar transactions, report them to your digital wallet provider immediately.

By following these steps, you can establish a secure digital wallet in the USA, safeguarding your financial transactions and personal information as you embrace the future of digital wallets

3 Main Challenges Of Developing A Digital Wallet

Developing a digital wallet app comes with its share of challenges requiring careful consideration and strategic planning.

Here are three main challenges:

1-Security and Privacy:

Ensuring robust security measures to safeguard user data, transactions, and personal information is paramount. The sensitivity of financial data makes digital wallets attractive targets for cyberattacks.

Developers must implement encryption, multi-factor authentication, and regular security audits to maintain user trust.

2-Integration Complexity:

Integrating with various payment gateways, financial institutions, and third-party services requires seamless interoperability. The challenge lies in dealing with diverse protocols, APIs, and standards while ensuring a smooth user experience.

3-Regulatory Compliance:

The financial industry is heavily regulated to prevent fraud, money laundering, and ensure consumer protection. Developers must navigate complex compliance standards like KYC (Know Your Customer) and AML (Anti-Money Laundering), which can impact app functionality and development timelines.

Addressing these challenges through careful planning, staying updated on security practices, collaborating with industry experts, and maintaining a user-centric approach will help create a successful and secure digital wallet app in the dynamic landscape of the USA.

Cost of a Digital Wallet App Development

The expenses associated with creating a digital wallet app for the USA market can differ substantially due to various influencing factors. Generally, the price range can be estimated as follows:

Basic Digital Wallet App:

For a basic app with essential features like payment processing and user accounts, the cost could range from $20,000 to $50,000. This would involve straightforward functionalities and minimal design complexity.

Mid-Range Digital Wallet App:

An app with more features such as loyalty programs, QR code scanning, and additional security layers might cost between $50,000 to $150,000. This range covers a more comprehensive user experience and customization.

Advanced Digital Wallet App:

For a feature-rich app with advanced functionalities like biometric authentication, AI-driven recommendations, and integrations with various payment gateways, the cost could exceed $150,000. These apps demand intricate design and complex programming.

Remember that these estimates can fluctuate based on development complexity, design intricacy, platform choice (iOS, Android, or both), technology stack, and the development team’s rates.

Collaborating closely with a reputable development team is crucial to get an accurate cost assessment tailored to your specific digital wallet app requirements.

Compilation of Sectors Profiting from Mobile Wallet Applications

Mobile wallet applications offer benefits across various industries in the USA, enhancing convenience and efficiency.

Here’s a list of industries that benefit from these applications:

Retail And E-Commerce:

Mobile wallets streamline online purchases, offering quick and secure payment options, loyalty program integration, and personalized offers.

Finance and Banking

Financial institutions leverage mobile wallets for contactless payments, fund transfers, and real-time account management.

Food And Beverage:

Restaurants and food delivery services use mobile wallets for seamless online orders, payments, and loyalty rewards.

Transportation:

Mobile wallets simplify payments for ridesharing services, public transportation, and parking.

Entertainment:

Ticketing platforms and streaming services utilize mobile wallets for easy and fast purchases of event tickets and subscription services.

Travel and Hospitality:

Mobile wallets facilitate hotel bookings, travel reservations, and mobile check-ins.

Healthcare:

Medical facilities adopt mobile wallets for contactless patient payments and easy insurance claims processing.

Utilities:

Mobile wallets enable hassle-free bill payments for utilities such as electricity, water, and gas.

Gaming And Apps:

In-app purchases and microtransactions in mobile games and applications are made efficient through mobile wallets.

Education:

Educational institutions use mobile wallets for tuition payments, course fees, and other educational expenses.

Charitable Organizations:

Mobile wallets make it easy for individuals to donate to charities and nonprofits securely.

Government Services:

Mobile wallets facilitate payments for government services like taxes, fines, and permits.

Real Estate:

Real estate agencies use mobile wallets for rental payments and property transactions.

Txend’s Expertise In Digital Wallet App Development

The widespread adoption of mobile wallet applications across these industries underscores the transformative potential of this technology in enhancing customer experiences, efficiency, and the overall digital landscape in the USA.

Txend stands as a trusted partner in digital wallet app development, offering a wealth of expertise tailored to the USA market. With a proven track record, Txend excels in creating secure, user-centric digital wallet solutions that align with evolving trends and consumer preferences.

Txend’s prowess lies in:

Strategic Planning:

Txend collaborates closely to understand your goals, tailoring development strategies for optimal user experiences and functionality.

Cutting-Edge Technology:

Leveraging the latest tools and frameworks, Txend crafts innovative digital wallet apps that meet market demands.

Security Focus:

Txend prioritizes robust security measures, implementing encryption, authentication protocols, and compliance standards to safeguard user data.

Customization:

Txend tailors solutions to your unique requirements, offering features like payment gateways, loyalty programs, and more.

Continuous Support:

Beyond development, Txend offers ongoing maintenance, ensuring app performance and staying attuned to future updates.

With Txend’s adeptness in digital wallet app development, you can navigate the dynamic landscape of the USA’s digital wallet industry, poised to deliver secure, convenient, and future-ready solutions.

Frequently Asked Questions

Yes, digital wallets incorporate encryption, authentication, and security measures to ensure safe transactions and protect user data, making them a secure payment method.

Monetize through transaction fees, subscription models, offering premium features, partnerships with businesses, in-app advertising, and referral programs to generate revenue.

Platforms include iOS and Android. Technologies encompass React Native or Flutter for cross-platform development, secure APIs, encryption standards, and robust back-end frameworks.

Key features include secure payment gateways, user-friendly interface, biometric authentication, transaction history, loyalty programs, QR code scanning, and real-time notifications for enhanced user experience and engagement.

Conclusion

In the dynamic landscape of financial technology, the journey through the guide to digital wallet app development opens doors to innovation and convenience. As we explore the future of digital wallets in the USA, it’s evident that crafting secure, user-centric solutions is pivotal.

Navigating this landscape requires expertise, and by harnessing the insights shared here, the future of digital wallet app in development holds immense promise for a seamless and transformative financial experience.