Key Takeaways | Benefits of Digital Wallets

- A digital wallet is a safe digital softwarethat empowers users to store and oversee diverse payment methods, facilitating easy online and in-store transactions. It replaces the need for physical cash and cards by digitally storing payment information.

- Investing in digital wallets offers enhanced transaction security, convenient mobile payments, and opportunities for customer loyalty programs, driving customer engagement and shaping the future of financial technology.

- Digital wallets provide seamless and secure transactions, enabling quick payments, simplified budget tracking, and access to exclusive rewards, transforming how we manage our finances.

- Digital wallets entail potential risks such as data breaches, unauthorised transactions, and loss of access due to device issues, highlighting the importance of robust security measures and cautious usage.

What Constitutes A Digital Wallet?

A digital wallet, often called an e-wallet or virtual wallet, is a secure and electronic means of storing, managing, and conducting various financial transactions through a digital platform.

It acts as a contemporary substitute for conventional physical wallets, enabling individuals to digitally retain their payment particulars, including credit or debit card specifics, bank account data, and even cryptocurrencies.

Digital wallets offer a convenient and efficient way to make various financial transactions, including online purchases, in-store payments, money transfers, bill payments, and more.

They can be accessed through dedicated mobile apps or online platforms, enabling users to make seamless transactions without needing physical cash or cards.

An essential aspect of digital wallets is their capacity to secure delicate financial information through the utilization of sophisticated encryption methods.

Furthermore, they frequently provide heightened security protocols like biometric validation (fingerprint or facial recognition) and dual-factor authentication, introducing an additional level of defense against unauthorized entry.

The convenience, speed, and security of digital wallets have led to their notable surge in popularity.

They contribute to the shift towards a cashless society, offering users a way to manage their finances and conduct transactions efficiently in the digital age.

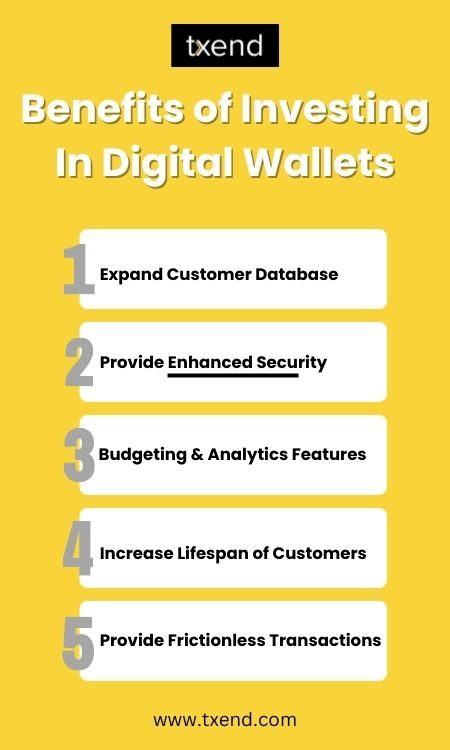

Investing in digital wallets brings a myriad of benefits, shaping a modern financial landscape:

5 Benefits Of Investing In Digital Wallets

Investing in digital wallets in the USA offers a range of compelling benefits that positively impact businesses and consumers alike.

Let’s delve into these advantages, accompanied by illustrative examples:

Expand Customer Database:

Digital wallets enable businesses to capture valuable customer data, enhancing personalised marketing strategies.

For instance, Starbucks’ mobile app gathers user preferences and purchase history, allowing tailored promotions that boost customer engagement.

Provide Enhanced Security:

Digital wallets incorporate advanced security measures like biometric authentication and tokenisation.

PayPal’s One Touch feature enables seamless transactions while safeguarding financial information, fostering trust among users.

Budgeting & Analytics Features:

Digital wallets often come with budgeting and spending analysis tools.

For instance, Apple Card’s Wallet app categorises expenses and provides visualised spending patterns, aiding users in managing their finances effectively.

Increase Lifespan of Customers:

Businesses encourage repeated usage by offering loyalty programs and rewards within digital wallets.

Walmart Pay integrates loyalty cards and receipts, incentivising customers to return and making their shopping experience more comprehensive.

Provide Frictionless Transactions:

Digital wallets streamline payments, reducing checkout times.

Amazon Go stores exemplify this by allowing shoppers to grab items and simply walk out, with their Amazon accounts automatically charged via the Amazon Go app.

Investing in digital wallets aligns businesses with the evolving preferences of tech-savvy consumers, fostering convenience, security, and engagement while propelling the future of digital payments in the USA.

7 Benefits Of Digital Wallets

Enhanced Security for Peace of Mind:

Digital wallets offer higher security, safeguarding personal and financial information through encryption and authentication.

For instance, platforms like Apple Pay use tokenization to replace card details with secure tokens during transactions, reducing the risk of sensitive data exposure.

Swift Transactions: Sending and Receiving Money Effortlessly:

Digital wallets enable instant peer-to-peer transactions. Apps like Venmo allow users to split bills, send funds, and even pay for goods swiftly using just their smartphones, eliminating the hassle of cash or check payments.

Seamless Contactless Payments:

With the rise of NFC technology, digital wallets like Google Wallet and Samsung Pay enable users to make touchless payments at physical stores.

This convenience is exemplified when users pay for groceries by tapping their phones on a compatible payment terminal.

Earn Rewards on Your Purchases:

Digital wallets often come with rewards programs.

For instance, the Starbucks mobile app lets users earn points for every purchase, leading to free drinks and food items after accumulating a certain number of points.

Global Money Transfers Made Easy:

Digital wallets can facilitate international money transfers.

PayPal allows users to send money to recipients in different countries, making it simpler and more cost-effective than traditional methods.

Instant Card Activation: No Waiting Time for Credit Card Usage:

Upon approval, some digital wallets like Apple Pay allow users to start using their virtual credit card immediately, enabling them to make purchases even before the physical card arrives.

Effortless Expense Tracking:

Digital wallets maintain a record of transactions, helping users track their spending patterns.

Apps like Mint offer budgeting features that categorise expenses, providing insights into where and how money is spent.

Embracing digital wallets goes beyond convenience; it’s about transforming how we manage our finances in a fast-paced and interconnected world.

Risks of Digital Wallets

Certainly, here’s an explanation of the risks of digital wallets, along with their mitigations:

Security Inconsistencies:

Digital wallets may have varying security standards, potentially exposing users to vulnerabilities.

Data Interception:

Data transmitted during transactions can be intercepted by cybercriminals, leading to unauthorised access.

Fraud Vulnerabilities:

Cybercriminals can exploit weaknesses to commit fraud, leading to unauthorised transactions and financial loss.

Device Loss or Damage:

Losing or damaging your phone can result in unauthorized access to your digital wallet.

Mitigating Risks of Digital Wallets

Security Inconsistencies:

Opt for renowned and reputable digital wallet providers known for their robust security protocols.

Regularly update your app and use additional security measures like biometric authentication.

Data Interception:

Employ strong encryption methods and secure communication channels within the app. Avoid using public Wi-Fi for sensitive transactions.

Fraud Vulnerabilities:

Stay vigilant against phishing attempts, verify app permissions, and enable transaction notifications to detect any unusual activity promptly.

Device Loss or Damage:

Set up remote device tracking and wiping features. Use strong device passwords and protect your digital wallet app with a PIN or biometric authentication.

How Can Txend Help In Giving These Benefits Of A Digital Wallet?

Txend catalyses harnessing the benefits of digital wallets for investors and consumers, revolutionising the financial landscape with its comprehensive solutions.

For Investors

Strategic Insights:

Txend provides investors with a deep understanding of digital wallet trends and market dynamics, ensuring informed decisions that align with the evolving financial ecosystem.

- Innovative Partnerships: By partnering with Txend, investors gain access to cutting-edge technology and platforms, empowering them to tap into the potential of digital wallets.

- Risk Mitigation: Txend employs rigorous security measures to address digital wallet fraud concerns and minimise risks for investors seeking secure and profitable ventures.

- Diversified Investment Avenues:Txend’s proficiency covers a range of digital wallet domains, presenting investors with a varied portfolio corresponding to their financial objectives and risk tolerance.

For Consumers

- Enhanced User Experience: Txend crafts user-centric digital wallets that prioritise convenience and security, ensuring consumers enjoy seamless transactions and financial management.

- Personalised Offerings: With Txend’s innovative solutions, consumers can access tailored benefits, rewards, and loyalty programs, enhancing their financial journey and incentivising digital wallet adoption.

- Financial Literacy: Txend prioritises educating consumers about the importance of digital payments, empowering them with the knowledge to make informed financial decisions.

- Security Assurance: Consumers can trust Txend’s robust security measures, safeguarding their transactions and data from digital wallet frauds and enabling them to transact with peace of mind.

- Inclusive Access: Txend’s solutions bridge the gap between traditional and digital finance, making digital wallets accessible to a broader demographic, including the unbanked and underbanked populations.

In essence, Txend’s role is pivotal in actualising the benefits of digital wallets for both investors and consumers. By offering a holistic ecosystem that prioritizes security, innovation, and user experience, Txend propels the digital wallet revolution forward, fostering a seamless synergy between financial stakeholders and the transformative potential of digital payments.

Lastly, Txend also offers customer service in case you want to get your bugs fixed after the application goes live.

Frequently Asked Questions

E-wallets provide students with convenience for making payments, managing expenses, and accessing discounts. They offer a secure platform to handle financial matters, cultivate responsible spending habits, and earn rewards.

A digital wallet stores payment information, such as credit card details and bank account numbers, securely in an app. The wallet encrypts and transmits the payment data when making a transaction, allowing seamless and secure online or in-store payments.

Investing in digital wallets involves researching publicly traded companies in the fintech sector, particularly those focusing on digital payment solutions. Look for well-established brands or innovative startups that show potential for growth in the digital wallet market.

Consider stocks, exchange-traded funds (ETFs), or investment platforms that allow exposure to relevant companies. It’s essential to consult with financial advisors and perform due diligence before making investment decisions.

Conclusion | Digital Wallets: 7 Benefits of Digital Wallets

In the landscape of modern finance, the benefits of digital wallets shine brightly. From virtual wallets to e-wallets, the advantages extend beyond convenience, transforming the way we handle transactions. The importance of digital payments becomes evident, offering enhanced security, swift transactions, and tailored rewards.

However, it’s essential to tread cautiously, as digital wallet frauds remind us of the need for vigilance. As we navigate this dynamic realm, harnessing the potential while safeguarding against risks becomes paramount.

Digital wallets are not just a technological evolution; they signify a shift in how we interact with our finances. By grasping the benefits, understanding the nuances, and embracing best practices, we embark on a journey that simplifies and empowers our financial experiences in the digital age.

if you work as freelancer if any buyer message you on fiverr, upwork, freelancer or anywhere Quick Alert for Freelancers and Entrepreneurs Software will instantly notified you by Phone call.