- Banking and Finance

- B2C Fintech Mobile Wallet System

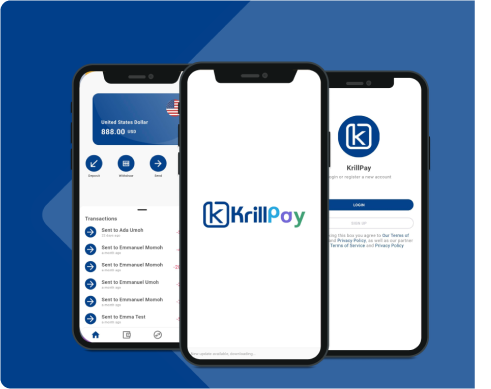

B2C Fintech Mobile Wallet System for a US/Africa Origin Startup

In an era where financial services are rapidly evolving, blockchain-based fintech applications are paving the way for seamless international money transfers. This case study delves into the collaboration between Txend, a leading custom software engineering company, and the groundbreaking "Krill Pay" fintech application. Krill Pay has been instrumental in simplifying the process of sending and receiving money for residents of Nigeria and the USA. Operating on a white-labeled backend system, this case study explores how Txend's expertise in custom software engineering has propelled Krill Pay to the forefront of the fintech industry.

Problem

Krill Pay set out with a mission to revolutionize cross-border money transfers between Nigeria and the USA. The challenge was evident from the outset, as it involved addressing the complexities of international transactions in two diverse financial ecosystems. Nigeria’s financial infrastructure is often fragmented, and remittances are encumbered by high costs and intermediaries. In the USA, residents faced difficulties accessing affordable and efficient international money transfer services. Krill Pay needed to navigate these obstacles to make cross-border transactions more accessible and cost-effective.

Creating a secure, blockchain-based infrastructure to handle international money transfers was a fundamental challenge. This required a deep understanding of blockchain technology, coupled with compliance to regulatory frameworks in both countries. Additionally, Krill Pay needed to ensure that its application was user-friendly, catering to individuals with varying levels of familiarity with blockchain technology.

The project also necessitated integration with various financial institutions and payment gateways, adding another layer of complexity. Protecting user data was of utmost importance, given the sensitivity of financial transactions.

Solution

Txend embraced these challenges by leveraging its expertise in custom software engineering. The project commenced with an in-depth analysis of the unique requirements and regulatory environments in Nigeria and the USA. This groundwork laid the foundation for a blockchain-based solution that could navigate the intricacies of cross-border remittances.

Txend’s custom software engineering team designed Krill Pay’s user interface to be user-friendly, making it accessible to individuals with varying levels of technical proficiency. The application allowed users to effortlessly send and receive money through a secure and intuitive platform, demystifying the complexities typically associated with blockchain technology.

Furthermore, Txend engineered a robust backend system that securely handled transactions and ensured compliance with regulatory guidelines in both countries. By integrating with financial institutions and payment gateways, the application streamlined the process, reducing costs and transfer times.

Security and data privacy were given paramount importance. Krill Pay implemented advanced encryption techniques to safeguard user data, ensuring compliance with the highest standards of data protection.

This case study will further explore how Txend’s custom software engineering approach transformed Krill Pay into a fintech powerhouse, reshaping cross-border money transfers in Nigeria and the USA. The project underscores the significant impact that technology, innovation, and a steadfast commitment to improving financial services can have on international money transfers.

TechStack

ReactNative, NodeJS, AWS, MongoDB, API Gateway, PHP, OWASP top guidelines, PCIDSS

Tagged Banking & Finance

if you work as freelancer if any buyer message you on fiverr, upwork, freelancer or anywhere Quick Alert for Freelancers and Entrepreneurs Software will instantly notified you by Phone call.