- Banking and Finance

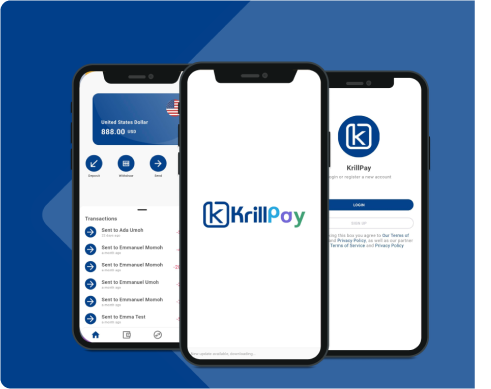

- B2C Fintech Mobile App for a US Startup

B2C Fintech Mobile App for a US Startup

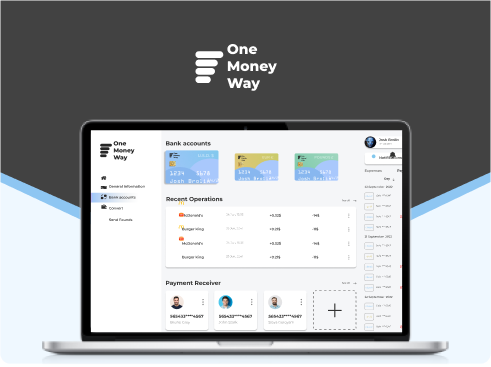

OneMoneyWay is one of the leading innovative software solutions company in Europe, targeting to ease SME businesses from their international or national money transfers. It is a highly robust online payment system for the SME businesses in the Europe.

Problem

When OneMoneyWay was started in 2021 it was with an idea of making business accounts easy and transparent for small businesses. Knowing first hand how hard it is to navigate the different banking products and waiting many months for an account, we decided to fix the problem ourselves.

From when we started we have grown to become a full fledged financial platform and we strive to innovate and better our offering every day, while maintaining our low prices.

We hired Txend to help us achieve the integrations with core banking and EMI license companies with our payments platform.

Solution

Our objective was to develop a groundbreaking instant payment system that facilitates secure peer-to-peer and peer-to-business transactions. The Txend team provided comprehensive services throughout the entire product development lifecycle. Their highly knowledgeable and experienced team supported us in various stages, including idea conceptualization, implementation, and subsequent growth, leading up to the successful launch.

Facing a pressing deadline for our launch, we encountered significant delays with our current team, which was initially responsible for designing the platform. Given our non-technical background, we required assistance from individuals who shared our background and could guide us in understanding the direction we were heading. In this critical situation, Txend stepped in and provided invaluable support by assuming responsibility for writing the entire application and enhancing the product. They took into account security constraints, technical debt, and the substantial cost of maintenance to ensure a successful upgrade.

TechStack

ReactJS, NodeJS, AWS, Restful, Microservices, Core banking Integrations

Tagged Banking & Finance